The FASB and IASB met separately on May 18 & May 20 (respectively) to discuss changes to lessor accounting consistent with the move to a right-to-use model for lease accounting. As previously discussed, the boards had decided to delay lessor accounting changes and move ahead with lessee accounting only, because they felt that the need for changes was more urgent for lessee accounting and lessor accounting had complexities that would slow the whole process down.

Now they're getting started with looking at lessor accounting directly, in part perhaps because they realized that sublease accounting is inevitably affected by lessee accounting, and sublease and lessor accounting are inextricably linked.

The boards dealt with a fundamental question in their approach to lessor accounting: Does a lease result in a transfer of a portion of the leased item from lessor to lessee, or does it create a new right and obligation for the lessor? Or as the staff puts it in their discussion paper, "What is the credit?" (Additional examples, with sample journal entries, are in a second discussion paper.) The debit in the transaction is clearly the creation of a receivable representing the discounted flow of rents. Should the credit be recognized as a reduction in the value of the asset on the lessor's books (a derecognition of part of the asset), or should the asset remain untouched and a separate performance obligation created to reflect the requirement to allow the lessee to use the asset?

The FASB staff, which wrote up the discussion paper, favored the first approach (Approach A), derecognizing a portion of the lessor's asset and keeping only the net on the lessor's books. However, the boards decided instead to recognize a performance obligation. The discussion at the IASB (available by webcast until August 19) raised a number of concerns with Approach A, one of the most compelling apparently being that it would result in a steadily diminishing asset on the books which could eventually go negative (if a building that is mostly depreciated, or land recorded at historical cost, is leased based on current market value). A separate but related issue was whether profit should be recognized at the inception of the lease. This is currently permitted for manufacturers and dealers under sales-type leases, but not for direct financing leases. A number of board members did not want to permit recognition of profit at inception, and Approach A was seen as facilitating or even demanding profit recognition. The FASB also preferred Approach B, with members stating their position in favor of no immediate profit recognition and keeping the full asset on the lessor's books as long as the lessor retains title. (A concern raised and not resolved by both boards was whether treatment should be different if the lease transfers ownership at the end of the lease term, so that no interest in the asset remains with the lessor.)

The boards remain concerned about opportunities for structuring transactions to avoid the regulations, and are trying to craft the new regulations to reduce the potential for structuring, ensuring that legal forms don't facilitate treating differently transactions of similar economic substance.

Next steps:

In meetings scheduled for July, the boards will discuss initial and subsequent measurement and presentation of the asset and liability, as well as how to recognize contingent rents and options. (The second discussion paper for the May meetings made assumptions for measurement, but these have not been decided on by the boards.) Additional items for discussion, not necessarily at the July meeting, include how to differentiate a sale of an asset from a lease, and whether the right-to-use model should apply to short-term and immaterial leases. Following that meeting, the boards will decide whether they have made enough progress on lessor accounting to include it in the Exposure Draft scheduled for mid-2010, or if the ED should remain lessee-only.

Monday, June 15, 2009

Tuesday, May 5, 2009

Types of EZ13 reports

This is in some ways a continuation of the prior blog entry on how to create spreadsheet output.

EZ13 provides several types of reports. Let's look at what each provides. (I'll describe specifically the spreadsheet output type #1; the text report includes basically the same information, but laid out differently.)

1) Income Statement/Balance Sheet Detail: This is our most comprehensive report of calculated information (all of the accounts involved in lease accounting for a period). We've tried to break out every account so you can see exactly what's happening. Each balance sheet account, for instance, shows five different values: beginning balance, added (for new leases), activity, removed (for terminations), and ending balance. In all, this report shows some 74 columns of calculated data, plus as many as 43 columns of descriptive information (including account numbers if you define them).

And that's just the first tab. On the second tab, we show the future minimum rent information. If you get minimum rents broken out by year for the first 5 years, then all remaining as a lump sum (as FAS 13 requires), the second tab shows 42 columns of calculated data per lease.

2) Income Statement/Balance Sheet Compact: Maybe that's overkill for you. The compact report shows 16 columns of calculated data, giving the essential highlights (just the ending balance for each balance sheet account, for instance).

3) Journal Entries: You may prefer to see each transaction a lease generates in journal entry form (each rent payment is a debit to obligation, a debit to accrued interest, and a credit to cash; etc.). Each line shows the lease number, period start and end date, account name, account number (if defined), debit or credit, and a description of the transaction so you know which lines go together and what they're for.

4) Amortization Schedule - Capital & Operating: You can view the activity for the entire life of a lease, with a separate line entry for each rent payment. Note that this report can get very large if you have many long leases; if you have several hundred leases that run 20 years or more paid monthly, you could exceed the maximum number of rows (65536) in versions of Excel before Office 2007. If that happens, you'll need to select subgroups of leases to report on (or upgrade Excel; the 2007 version permits over 1 million rows).

5) Future Minimum Rents: This report is identical to the second tab of the Income Statement/Balance Sheet Detail report. It's provided in case you only need future rent information.

6) Depreciation Over Economic Life: If you have leases that have an ownership transfer or bargain purchase option, they are depreciated over their economic life, which in most cases is longer than the lease term. Regular EZ13 reports stop reporting on a lease when it expires. This report shows the depreciation after the lease's expiration, until the end of its economic life.

7) Classification Summary: Lists how each lease fits into the four tests for capitalization; if the lease is capital, its capital rate is shown.

8) Listing: As mentioned above, this report is not available in spreadsheet format except as an export of a text report. The reason is that there is really no way to show all the input information for a lease across a single row: There can be an indeterminate number of rent steps, for instance, which can easily overwhelm the maximum number of columns in Excel.

I hope this helps you get the results most useful to you. Most accountants and financial people live in Excel, and it's also a common method of importing and exporting data (such as loading results of EZ13 into a general ledger system). Knowing the best way to get the spreadsheet information you want can make EZ13 much more useful.

EZ13 provides several types of reports. Let's look at what each provides. (I'll describe specifically the spreadsheet output type #1; the text report includes basically the same information, but laid out differently.)

1) Income Statement/Balance Sheet Detail: This is our most comprehensive report of calculated information (all of the accounts involved in lease accounting for a period). We've tried to break out every account so you can see exactly what's happening. Each balance sheet account, for instance, shows five different values: beginning balance, added (for new leases), activity, removed (for terminations), and ending balance. In all, this report shows some 74 columns of calculated data, plus as many as 43 columns of descriptive information (including account numbers if you define them).

And that's just the first tab. On the second tab, we show the future minimum rent information. If you get minimum rents broken out by year for the first 5 years, then all remaining as a lump sum (as FAS 13 requires), the second tab shows 42 columns of calculated data per lease.

2) Income Statement/Balance Sheet Compact: Maybe that's overkill for you. The compact report shows 16 columns of calculated data, giving the essential highlights (just the ending balance for each balance sheet account, for instance).

3) Journal Entries: You may prefer to see each transaction a lease generates in journal entry form (each rent payment is a debit to obligation, a debit to accrued interest, and a credit to cash; etc.). Each line shows the lease number, period start and end date, account name, account number (if defined), debit or credit, and a description of the transaction so you know which lines go together and what they're for.

4) Amortization Schedule - Capital & Operating: You can view the activity for the entire life of a lease, with a separate line entry for each rent payment. Note that this report can get very large if you have many long leases; if you have several hundred leases that run 20 years or more paid monthly, you could exceed the maximum number of rows (65536) in versions of Excel before Office 2007. If that happens, you'll need to select subgroups of leases to report on (or upgrade Excel; the 2007 version permits over 1 million rows).

5) Future Minimum Rents: This report is identical to the second tab of the Income Statement/Balance Sheet Detail report. It's provided in case you only need future rent information.

6) Depreciation Over Economic Life: If you have leases that have an ownership transfer or bargain purchase option, they are depreciated over their economic life, which in most cases is longer than the lease term. Regular EZ13 reports stop reporting on a lease when it expires. This report shows the depreciation after the lease's expiration, until the end of its economic life.

7) Classification Summary: Lists how each lease fits into the four tests for capitalization; if the lease is capital, its capital rate is shown.

8) Listing: As mentioned above, this report is not available in spreadsheet format except as an export of a text report. The reason is that there is really no way to show all the input information for a lease across a single row: There can be an indeterminate number of rent steps, for instance, which can easily overwhelm the maximum number of columns in Excel.

I hope this helps you get the results most useful to you. Most accountants and financial people live in Excel, and it's also a common method of importing and exporting data (such as loading results of EZ13 into a general ledger system). Knowing the best way to get the spreadsheet information you want can make EZ13 much more useful.

Monday, May 4, 2009

EZ13 spreadsheet output

With the review of the leases discussion paper complete (see previous blog entries for a chapter by chapter review), I thought I'd take some time to review some aspects of EZ13, our lease accounting software that provides complete compliance with FAS 13 for lessee leases (and FAS 13 compliance for most lessor leases as well, in the separate lessor edition).

Based on questions we've gotten from customers, it seems there's some confusion about the ways to get output, particularly spreadsheet output. EZ13 offers two different ways to get spreadsheet output, each having a different purpose.

1) Most people wanting spreadsheet output will want a format where each lease is on a single line, with the accounts and values for that lease each in a separate column. For this type of output, you should choose output to "Spreadsheet" in the report setup page:

As soon as you click on the Spreadsheet button, EZ13 will open a dialog box for the name of the spreadsheet. Most people will create an Excel spreadsheet (.xls format). However, this requires that you have a valid installation of Excel on your computer. If you do not, you can create spreadsheet output in XML format, which can be read by Excel, OpenOffice Calc, and various other spreadsheet applications. To select XML output, go to the File menu, choose System Options, and check the box labeled "XML spreadsheet output." (XML output is also a bit faster to create, and less subject to memory limitations with very large reports.)

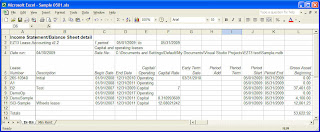

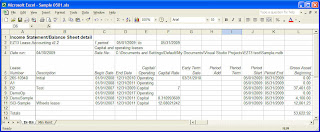

Once you click on Generate Report, EZ13 will build the spreadsheet. The output for an Income Statement/Balance Sheet Detail report looks something like this:

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).

2) The other way to get spreadsheet output is using the Export feature of the text output. Text output is designed to be easily readable, putting all the information for a lease together on several lines so that you don't have to constantly scroll back and forth across the line. However, that makes it much less practical to manipulate (sort, select, sum, etc.) in Excel. One advantage of this method of getting spreadsheet output, however, is that the report writer can create an Excel spreadsheet without you having Excel installed on your computer. Also, this is the only way to get a spreadsheet of the listing report, which lists all the input data for a lease.

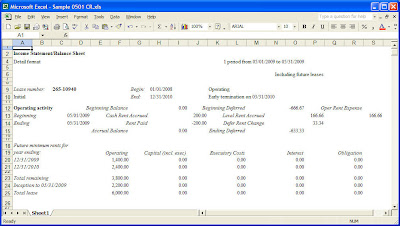

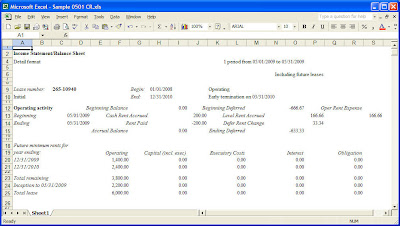

If you create a text output version of this same report, then export it to Excel, it will look something like this:

This is basically a repeat of what you see on the screen for a text report. Note that sometimes the columns won't line up correctly; the report writer is trying its best to guess what should be aligned, but it doesn't always make the right decisions, and unfortunately there's no way for us to tweak the results. In most cases, an export to PDF, HTML, or a Word .doc document is going to give better looking results. But if you really prefer to get information in Excel format, it's here.

Based on questions we've gotten from customers, it seems there's some confusion about the ways to get output, particularly spreadsheet output. EZ13 offers two different ways to get spreadsheet output, each having a different purpose.

1) Most people wanting spreadsheet output will want a format where each lease is on a single line, with the accounts and values for that lease each in a separate column. For this type of output, you should choose output to "Spreadsheet" in the report setup page:

As soon as you click on the Spreadsheet button, EZ13 will open a dialog box for the name of the spreadsheet. Most people will create an Excel spreadsheet (.xls format). However, this requires that you have a valid installation of Excel on your computer. If you do not, you can create spreadsheet output in XML format, which can be read by Excel, OpenOffice Calc, and various other spreadsheet applications. To select XML output, go to the File menu, choose System Options, and check the box labeled "XML spreadsheet output." (XML output is also a bit faster to create, and less subject to memory limitations with very large reports.)

Once you click on Generate Report, EZ13 will build the spreadsheet. The output for an Income Statement/Balance Sheet Detail report looks something like this:

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).2) The other way to get spreadsheet output is using the Export feature of the text output. Text output is designed to be easily readable, putting all the information for a lease together on several lines so that you don't have to constantly scroll back and forth across the line. However, that makes it much less practical to manipulate (sort, select, sum, etc.) in Excel. One advantage of this method of getting spreadsheet output, however, is that the report writer can create an Excel spreadsheet without you having Excel installed on your computer. Also, this is the only way to get a spreadsheet of the listing report, which lists all the input data for a lease.

If you create a text output version of this same report, then export it to Excel, it will look something like this:

This is basically a repeat of what you see on the screen for a text report. Note that sometimes the columns won't line up correctly; the report writer is trying its best to guess what should be aligned, but it doesn't always make the right decisions, and unfortunately there's no way for us to tweak the results. In most cases, an export to PDF, HTML, or a Word .doc document is going to give better looking results. But if you really prefer to get information in Excel format, it's here.

Thursday, April 30, 2009

DP Review: Overall comments

Please look at the last several blog entries for a chapter by chapter summary of the FASB/IASB joint Discussion Paper, Leases: Preliminary Views.

Change is coming. There is no question that both boards are adamant that leases need to be on the balance sheet. Operating leases will cease to exist for lessees once this standard takes effect, with only a possible exception for very short-term leases. The impact of this is expected to be substantial for many industries, particularly retail chains (including restaurants), airlines, property management firms, and others with large amounts of assets held under operating leases. We can also expect a substantial impact on lessors; one reason for leasing is off-balance-sheet financing, and with everything being on the balance sheet, one can expect that some leases will be less financial advantageous to the lessee, and so won’t get done, or at least not with the same terms.

When FAS 13 was first issued in 1976, it was the most complex standard the FASB had released (and probably more complex than standards released by its predecessors as well). The new standard is no doubt intended to be less complex, in keeping with the move to principles-based rather than rules-based accounting. But the wide variety of leasing transactions means some inherent complexity as the boards seek to develop a consistent methodology.

Another big change in the accounting is the requirement for continuous review and adjustment. FAS 13 was basically “set and forget”: the terms in effect at the inception of the lease controlled accounting for the entire lease term, unless there was an actual renegotiation. A renewal or termination option was not recognized until officially exercised. Contingent rents were expensed as incurred, with no implications on future rents (either the minimum rent disclosures or the asset & obligation of a capital lease).

With the new standard, the lessee would review all of these every reporting date (in the U.S., that generally means every quarter). Contingent rent is estimated from the very beginning of the lease, and as it changes, the rent obligation would be recalculated (though the boards can’t agree whether the balancing entry would be to asset or profit). Options to renew will be included based on factors outside the lease such as the loss of valuable leasehold improvements, relocation costs, and industry practice, not just the existence of a penalty or other factors in the lease itself, and this inclusion decision would again be reviewed quarterly, not just when the option exercise date arrives. (For U.S. lessees, the SEC Chief Accountant’s letter of Feb. 7, 2005, made leasehold improvements a reason to include renewal options, but this proposal’s wording is broader.)

This means that the calculations for capital leases are going to become more complex, particularly in handling midcourse adjustments, which are likely to become much more numerous. (Any retail store lease with a percentage of sales kicker will probably need to be adjusted every quarter to reflect actual sales; leases with CPI clauses will need adjustments at least once a year, and perhaps quarterly.) Since some changes in rents can result in a change to both the obligation and the asset, there is no certainty that the periodic depreciation charge will remain the same throughout the lease (since the asset being depreciated may change). Depending on how the boards resolve their disagreements, it’s possible that gains and losses will be recognized in the middle of the life of a lease when certain changes are recognized, rather than just at termination.

For all the work done, there is much left to accomplish. And one topic hasn’t even been discussed: transition to the new standard. How are existing leases to be recognized? Restate from inception? Grandfather? Set up as if a new lease on a specific day, or the first day of the fiscal year in which the standard takes effect? For capital leases which change, does the change hit profit or retained earnings, or is it part of the new lease’s carrying amount?

The boards welcome public input; that’s the purpose of a discussion paper. If you want to make a response, you are invited to contact either board (but not both; all comments will be shared between the two boards), by July 17, 2009.

FASB email: Send to director@fasb.org, File Reference #1680-100.

IASB online: Use their web form for comments.

Note that all comments will become part of the public record, available on the boards’ web sites.

FCS is committed to updating EZ13 to meet the new lease accounting standard once it is released. The current Standard Edition of EZ13 includes the ability to treat operating leases as capital at their incremental borrowing rate; we are adding the ability to use the incremental borrowing rate on capital leases in v2.3, which we expect to release next month.

Change is coming. There is no question that both boards are adamant that leases need to be on the balance sheet. Operating leases will cease to exist for lessees once this standard takes effect, with only a possible exception for very short-term leases. The impact of this is expected to be substantial for many industries, particularly retail chains (including restaurants), airlines, property management firms, and others with large amounts of assets held under operating leases. We can also expect a substantial impact on lessors; one reason for leasing is off-balance-sheet financing, and with everything being on the balance sheet, one can expect that some leases will be less financial advantageous to the lessee, and so won’t get done, or at least not with the same terms.

When FAS 13 was first issued in 1976, it was the most complex standard the FASB had released (and probably more complex than standards released by its predecessors as well). The new standard is no doubt intended to be less complex, in keeping with the move to principles-based rather than rules-based accounting. But the wide variety of leasing transactions means some inherent complexity as the boards seek to develop a consistent methodology.

Another big change in the accounting is the requirement for continuous review and adjustment. FAS 13 was basically “set and forget”: the terms in effect at the inception of the lease controlled accounting for the entire lease term, unless there was an actual renegotiation. A renewal or termination option was not recognized until officially exercised. Contingent rents were expensed as incurred, with no implications on future rents (either the minimum rent disclosures or the asset & obligation of a capital lease).

With the new standard, the lessee would review all of these every reporting date (in the U.S., that generally means every quarter). Contingent rent is estimated from the very beginning of the lease, and as it changes, the rent obligation would be recalculated (though the boards can’t agree whether the balancing entry would be to asset or profit). Options to renew will be included based on factors outside the lease such as the loss of valuable leasehold improvements, relocation costs, and industry practice, not just the existence of a penalty or other factors in the lease itself, and this inclusion decision would again be reviewed quarterly, not just when the option exercise date arrives. (For U.S. lessees, the SEC Chief Accountant’s letter of Feb. 7, 2005, made leasehold improvements a reason to include renewal options, but this proposal’s wording is broader.)

This means that the calculations for capital leases are going to become more complex, particularly in handling midcourse adjustments, which are likely to become much more numerous. (Any retail store lease with a percentage of sales kicker will probably need to be adjusted every quarter to reflect actual sales; leases with CPI clauses will need adjustments at least once a year, and perhaps quarterly.) Since some changes in rents can result in a change to both the obligation and the asset, there is no certainty that the periodic depreciation charge will remain the same throughout the lease (since the asset being depreciated may change). Depending on how the boards resolve their disagreements, it’s possible that gains and losses will be recognized in the middle of the life of a lease when certain changes are recognized, rather than just at termination.

For all the work done, there is much left to accomplish. And one topic hasn’t even been discussed: transition to the new standard. How are existing leases to be recognized? Restate from inception? Grandfather? Set up as if a new lease on a specific day, or the first day of the fiscal year in which the standard takes effect? For capital leases which change, does the change hit profit or retained earnings, or is it part of the new lease’s carrying amount?

The boards welcome public input; that’s the purpose of a discussion paper. If you want to make a response, you are invited to contact either board (but not both; all comments will be shared between the two boards), by July 17, 2009.

FASB email: Send to director@fasb.org, File Reference #1680-100.

IASB online: Use their web form for comments.

Note that all comments will become part of the public record, available on the boards’ web sites.

FCS is committed to updating EZ13 to meet the new lease accounting standard once it is released. The current Standard Edition of EZ13 includes the ability to treat operating leases as capital at their incremental borrowing rate; we are adding the ability to use the incremental borrowing rate on capital leases in v2.3, which we expect to release next month.

Wednesday, April 29, 2009

DP Chapter 10: Lessor accounting

Continuing with the review of the FASB & IASB Discussion Paper on revising lease accounting. Today’s installment covers chapter 10.

Summary:

The boards list some of the issues that need to be resolved to set up lessor accounting in a right-to-use model, as well as to properly handle subleases. Subleases must be addressed with the lessee standard, but the boards have yet to discuss the alternatives available, such as using existing sublease rules with the new lessee standard, keeping leases with subleases under the existing standards, or defining a new right-to-use methodology for subleases before doing so for lessor leases.

Detailed review:

Lessor leases

In July 2008, the boards decided that rewriting lessor accounting would slow their project too much, and that the more crucial need was for a revised lessee standard. Therefore, they decided to postpone making any changes to lessor accounting, so as not to delay further the lessee standard (which has already been delayed two years from the original schedule).

This chapter describes in general how a right-to-use model might apply to lessors. The first option would convert the original asset into two assets: a receivable (a financial asset) for the rents due, plus a residual value (non-financial) asset for the remainder of the asset’s value after the end of the lease. (Alternatively, the lessor might derecognize only the portion of the original asset that matches the receivable, leaving the remaining asset portion on the books.) No obligation would be recognized.

The second possible approach to lessor accounting would create a liability to recognize the lease (the performance obligation to provide the asset to the lessee), while leaving the original asset on the lessor’s books and creating a new asset for the receivable (equal to the obligation).

The boards would need to decide when, if ever, profit (or loss) could be recognized on the lease, particularly keeping in mind that many manufacturers lease equipment as a method of sales. For such transactions, recognizing profit on the “sale” would seem more appropriate, more consistent with similar transactions, than recognizing just interest income. (This is currently done with sales-type lessor leases under FAS 13.) On the other hand, if a bank is providing the financing on the lease, one would normally expect all the income to come through interest.

Subleases

After the decision to defer lessor accounting, the boards were reminded that subleases raise many of the same issues as lessor leases. Leaving sublease accounting alone while changing lessee accounting raises issues, because current sublease accounting uses a different methodology that results in different measurements and inconsistencies in treatment. At the least, the boards would probably offer additional guidance on how to apply the current standards to subleases in the new regime. They suggest that they could also require additional disclosures.

Alternatively, the boards could exclude a head lease from the scope of the new standard, so that a lease with a sublease would continue to be accounted for as under the current standard (FAS 13/IAS 17). However, this reduces comparability because leases with subleases would be accounted for differently than other leases. It leaves those leases out of the head lessee’s balance sheet, understating its assets and obligations. And no one knows what to do if a sublease is entered into after the start of the head lease.

A third option is to develop a lessor right-to-use model for subleases only. This would be more consistent through the whole series of transactions. But it would be inconsistent with the current lessor accounting model, which means that a lessor that buys some of its assets to lease out and leases others (resulting in some lessor leases and some subleases) would account for the transactions differently, some under FAS 13/IAS 17 and others under the new standard. And the boards would have to work through many of the issues of lessor accounting, even though they wanted to defer that.

The boards note the following additional issues which need to be dealt with for lessor accounting:

(a) investment property

(b) initial and subsequent measurement

(c) leases with options

(d) contingent rentals and residual value guarantees

(e) leveraged leases (for US GAAP)

(f) presentation

(g) disclosure

Investment property is the only issue discussed in detail; the others are simply named. Investment property is treated different by US GAAP (FASB standards) and IFRSs (IASB standards); international standards exclude investment property from IAS 17 lease accounting, instead using IAS 40, Investment Property, which among other things includes an option for carrying the property at fair value rather than cost. It remains to be decided whether investment property would continue to be excluded from lease accounting, or otherwise treated differently from other lessor leases. (US GAAP does not differentiate investment property and accounts for it under FAS 13 as any other lease.)

Summary:

The boards list some of the issues that need to be resolved to set up lessor accounting in a right-to-use model, as well as to properly handle subleases. Subleases must be addressed with the lessee standard, but the boards have yet to discuss the alternatives available, such as using existing sublease rules with the new lessee standard, keeping leases with subleases under the existing standards, or defining a new right-to-use methodology for subleases before doing so for lessor leases.

Detailed review:

Lessor leases

In July 2008, the boards decided that rewriting lessor accounting would slow their project too much, and that the more crucial need was for a revised lessee standard. Therefore, they decided to postpone making any changes to lessor accounting, so as not to delay further the lessee standard (which has already been delayed two years from the original schedule).

This chapter describes in general how a right-to-use model might apply to lessors. The first option would convert the original asset into two assets: a receivable (a financial asset) for the rents due, plus a residual value (non-financial) asset for the remainder of the asset’s value after the end of the lease. (Alternatively, the lessor might derecognize only the portion of the original asset that matches the receivable, leaving the remaining asset portion on the books.) No obligation would be recognized.

The second possible approach to lessor accounting would create a liability to recognize the lease (the performance obligation to provide the asset to the lessee), while leaving the original asset on the lessor’s books and creating a new asset for the receivable (equal to the obligation).

The boards would need to decide when, if ever, profit (or loss) could be recognized on the lease, particularly keeping in mind that many manufacturers lease equipment as a method of sales. For such transactions, recognizing profit on the “sale” would seem more appropriate, more consistent with similar transactions, than recognizing just interest income. (This is currently done with sales-type lessor leases under FAS 13.) On the other hand, if a bank is providing the financing on the lease, one would normally expect all the income to come through interest.

Subleases

After the decision to defer lessor accounting, the boards were reminded that subleases raise many of the same issues as lessor leases. Leaving sublease accounting alone while changing lessee accounting raises issues, because current sublease accounting uses a different methodology that results in different measurements and inconsistencies in treatment. At the least, the boards would probably offer additional guidance on how to apply the current standards to subleases in the new regime. They suggest that they could also require additional disclosures.

Alternatively, the boards could exclude a head lease from the scope of the new standard, so that a lease with a sublease would continue to be accounted for as under the current standard (FAS 13/IAS 17). However, this reduces comparability because leases with subleases would be accounted for differently than other leases. It leaves those leases out of the head lessee’s balance sheet, understating its assets and obligations. And no one knows what to do if a sublease is entered into after the start of the head lease.

A third option is to develop a lessor right-to-use model for subleases only. This would be more consistent through the whole series of transactions. But it would be inconsistent with the current lessor accounting model, which means that a lessor that buys some of its assets to lease out and leases others (resulting in some lessor leases and some subleases) would account for the transactions differently, some under FAS 13/IAS 17 and others under the new standard. And the boards would have to work through many of the issues of lessor accounting, even though they wanted to defer that.

The boards note the following additional issues which need to be dealt with for lessor accounting:

(a) investment property

(b) initial and subsequent measurement

(c) leases with options

(d) contingent rentals and residual value guarantees

(e) leveraged leases (for US GAAP)

(f) presentation

(g) disclosure

Investment property is the only issue discussed in detail; the others are simply named. Investment property is treated different by US GAAP (FASB standards) and IFRSs (IASB standards); international standards exclude investment property from IAS 17 lease accounting, instead using IAS 40, Investment Property, which among other things includes an option for carrying the property at fair value rather than cost. It remains to be decided whether investment property would continue to be excluded from lease accounting, or otherwise treated differently from other lessor leases. (US GAAP does not differentiate investment property and accounts for it under FAS 13 as any other lease.)

Tuesday, April 28, 2009

DP Chapter 9: Other lessee issues

Continuing with the review of the FASB & IASB Discussion Paper on revising lease accounting. Today’s installment covers chapter 9.

Summary:

The boards have not yet discussed, but plan to make decisions on, the following topics:

• Timing of initial recognition

• Sale and leaseback transactions

• Initial direct costs

• Leases that include service arrangements

• Disclosure

Detailed review:

This is only one of a large number of accounting standards projects that are taking place simultaneously (the FASB project web page lists at least 37 different projects currently underway), and so even though the boards started this project in July 2006, they have not had enough time to discuss everything that will need to be resolved to produce a new standard. The following are issues that they recognize they need to work on:

Timing of initial recognition

There is often a gap of time between when a lease is signed and when it starts (the lessee takes possession of the asset and starts paying rent). Currently, a capital lease doesn’t hit the balance sheet until the lease starts. However, it could be argued that signing a lease results in rights and obligations that meet the standard definition of assets and liabilities. In rebuttal, some argue that before delivery, the lease agreement is an executory contract, which is not normally recognized on the balance sheet.

Therefore, the boards much decide if the assets and liabilities should be recognized at signing. If recognition is required, an appropriate measurement of value is needed, as it may not be the same as the asset/liability at the start of the lease. In addition, if construction is required during the period between signing and occupancy, there may be additional measurement issues, as rent may be subject to adjustment for construction costs, and so the exact amount is not known at signing.

Sale and leaseback transactions

A popular recent method of financing has been a sale/leaseback transaction, wherein an owner of an asset (most often real estate) sells the asset and leases it back. In some cases, FAS 98 prohibits the transaction from being recognized as a sale and a lease; instead, it must be treated as a deposit or financing, with the asset remaining on the books of the original owner and no lease shown. The continuing involvement can result in valuations that aren’t consistent with market values (there might be a below-market sales price in exchange for a below-market rent, for instance).

The boards will consider several options for sale/leaseback transactions:

IAS 17 currently calls for costs incurred in negotiating & arranging a lease (such as commissions, legal fees, and internal costs) to be added to the asset value of a capital lease and amortized over its life. FAS 13 has no such requirement; such costs are immediately expensed. IAS 17 is consistent with the treatment of costs associated with purchasing assets; FAS 13 is consistent with the treatment of costs in business combinations and for the acquisition of some financial instruments. The boards must decide which direction to take.

Leases that include service arrangements

Currently, costs for services associated with leases are considered executory costs, which are excluded from capitalization. Some leases clearly define the costs that are for services vs. the rent for the asset. Others, however, do not; with all leases capitalized, it becomes more important to properly separate service costs from asset costs. The boards will consider providing additional guidance.

Disclosure

The boards have not discussed disclosures; the primary current disclosure is the footnote report of future minimum lease payments. The boards will consider whether disclosures should provide additional information regarding the presence of options and contingencies.

Summary:

The boards have not yet discussed, but plan to make decisions on, the following topics:

• Timing of initial recognition

• Sale and leaseback transactions

• Initial direct costs

• Leases that include service arrangements

• Disclosure

Detailed review:

This is only one of a large number of accounting standards projects that are taking place simultaneously (the FASB project web page lists at least 37 different projects currently underway), and so even though the boards started this project in July 2006, they have not had enough time to discuss everything that will need to be resolved to produce a new standard. The following are issues that they recognize they need to work on:

Timing of initial recognition

There is often a gap of time between when a lease is signed and when it starts (the lessee takes possession of the asset and starts paying rent). Currently, a capital lease doesn’t hit the balance sheet until the lease starts. However, it could be argued that signing a lease results in rights and obligations that meet the standard definition of assets and liabilities. In rebuttal, some argue that before delivery, the lease agreement is an executory contract, which is not normally recognized on the balance sheet.

Therefore, the boards much decide if the assets and liabilities should be recognized at signing. If recognition is required, an appropriate measurement of value is needed, as it may not be the same as the asset/liability at the start of the lease. In addition, if construction is required during the period between signing and occupancy, there may be additional measurement issues, as rent may be subject to adjustment for construction costs, and so the exact amount is not known at signing.

Sale and leaseback transactions

A popular recent method of financing has been a sale/leaseback transaction, wherein an owner of an asset (most often real estate) sells the asset and leases it back. In some cases, FAS 98 prohibits the transaction from being recognized as a sale and a lease; instead, it must be treated as a deposit or financing, with the asset remaining on the books of the original owner and no lease shown. The continuing involvement can result in valuations that aren’t consistent with market values (there might be a below-market sales price in exchange for a below-market rent, for instance).

The boards will consider several options for sale/leaseback transactions:

- Treating all sale/leasebacks as financings—the sale and lease would be ignored, and sales proceeds would be treated as a liability, repaid by the “lease” payments like any other loan. If this option is chosen, the boards need to decide if there are circumstances under which a gain or loss could result from the sale.

- Treating all sale/leasebacks as sales—the asset would be sold and taken off the balance sheet, and a regular lease recognized with asset and obligation. If this option is chosen, the boards need to decide in what, if any, situations a gain on the sale would be deferred.

- A hybrid approach, treating some transactions as financings and others as sales, depending on whether the transaction meets certain criteria (perhaps using those in current standards). This, of course, raises the potential for structuring.

IAS 17 currently calls for costs incurred in negotiating & arranging a lease (such as commissions, legal fees, and internal costs) to be added to the asset value of a capital lease and amortized over its life. FAS 13 has no such requirement; such costs are immediately expensed. IAS 17 is consistent with the treatment of costs associated with purchasing assets; FAS 13 is consistent with the treatment of costs in business combinations and for the acquisition of some financial instruments. The boards must decide which direction to take.

Leases that include service arrangements

Currently, costs for services associated with leases are considered executory costs, which are excluded from capitalization. Some leases clearly define the costs that are for services vs. the rent for the asset. Others, however, do not; with all leases capitalized, it becomes more important to properly separate service costs from asset costs. The boards will consider providing additional guidance.

Disclosure

The boards have not discussed disclosures; the primary current disclosure is the footnote report of future minimum lease payments. The boards will consider whether disclosures should provide additional information regarding the presence of options and contingencies.

Monday, April 27, 2009

DP Chapter 8: Presentation

Continuing with the review of the FASB & IASB Discussion Paper on revising lease accounting. Today’s installment covers chapter 8.

Summary:

Once again, the boards have gone in slightly different directions. While they agree that the obligation and asset for a lease should be reported on the lessee’s balance sheet, they differ on how for the obligation. The IASB sees no need to separate lease obligations from other obligations; the FASB does, in part because they consider the uncertain nature of obligations related to options to change the quality of the value. For the assets, the boards agree that they should be reported according to the nature of the underlying asset, rather than grouped together as leases, though they do want to see leased assets separated from owned assets of the same type as a subledger entry.

The boards rejected options to present some or all leased assets as an intangible asset. Some FASB members want to do that for leases that are not “in substance purchases” (a concept first raised in chapter 5, but one that has not been defined by those members or the board; at the least, it would seem to include leases with an ownership transfer or bargain purchase option, but whether it covers other leases is unclear).

On the income statement, leases for property, plant, and equipment should show depreciation, while the term used for intangible assets is amortization. Interest expense would be shown separately from other interest if (as the FASB prefers) lease obligations are separated from other obligations.

The cash flows presentation is tied to the boards’ separate discussion paper, Preliminary Views on Financial Statement Presentation; the boards have not discussed it specifically as part of the lease accounting review. According to those preliminary views (which will presumably be finalized prior to finalization of the lease accounting standard), a leased asset is considered a business asset, and the lessee must decide whether to classify it as an operating or an investing asset based on the nature of the asset and its use. The obligation and interest could be classified by the lessee as an operating, investing, or financing liability.

Again, the boards will need to come to a common agreement where they differ. How they decide will depend in part on the responses they receive from the public to this discussion paper.

Summary:

- Lease obligations should be reported as a financial liability; the boards disagree on whether they should be reported separately from other financial liabilities.

- Lease assets should be reported according to the nature of the underlying asset (leases on vehicles with owned vehicles, etc.).

- Leases of property, plant, and equipment generate “depreciation” while those of intangible assets generate “amortization.”

- Interest expense would be separated from other interest if obligations are separated.

- For cash flows presentation, the lessee must classify the lease asset as operating or investing; the obligation and interest could be classified operating, investing, or financing.

Once again, the boards have gone in slightly different directions. While they agree that the obligation and asset for a lease should be reported on the lessee’s balance sheet, they differ on how for the obligation. The IASB sees no need to separate lease obligations from other obligations; the FASB does, in part because they consider the uncertain nature of obligations related to options to change the quality of the value. For the assets, the boards agree that they should be reported according to the nature of the underlying asset, rather than grouped together as leases, though they do want to see leased assets separated from owned assets of the same type as a subledger entry.

The boards rejected options to present some or all leased assets as an intangible asset. Some FASB members want to do that for leases that are not “in substance purchases” (a concept first raised in chapter 5, but one that has not been defined by those members or the board; at the least, it would seem to include leases with an ownership transfer or bargain purchase option, but whether it covers other leases is unclear).

On the income statement, leases for property, plant, and equipment should show depreciation, while the term used for intangible assets is amortization. Interest expense would be shown separately from other interest if (as the FASB prefers) lease obligations are separated from other obligations.

The cash flows presentation is tied to the boards’ separate discussion paper, Preliminary Views on Financial Statement Presentation; the boards have not discussed it specifically as part of the lease accounting review. According to those preliminary views (which will presumably be finalized prior to finalization of the lease accounting standard), a leased asset is considered a business asset, and the lessee must decide whether to classify it as an operating or an investing asset based on the nature of the asset and its use. The obligation and interest could be classified by the lessee as an operating, investing, or financing liability.

Again, the boards will need to come to a common agreement where they differ. How they decide will depend in part on the responses they receive from the public to this discussion paper.

Subscribe to:

Posts (Atom)