Tuesday, January 31, 2012

EZ13 and Asset Retirement Obligations (ARO)

Asset Retirement Obligations are legal obligations of a company that take effect at the retirement of an asset. Most commonly, they are involved with restoring the asset to its original (pre-use) condition. One common example is cleanup of a drilling site by an oil/gas driller. Another applies to gas stations, which are required to dig up their underground fuel tanks when the station closes (or when the tank reaches the end of its useful life).

Under FAS 143, now called ASC Topic 410-20, a company must estimate the cost of the asset's retirement, most commonly by determining the current cost and applying an inflation factor to get the future cost. (Even if you expect to take care of the work using internal resources, the ARO must be priced based on hiring the work to be done; if you end up actually using internal resources, you will book a gain at that time.) It then books the present value of that cost (using its "credit-adjusted risk-free rate" for borrowing); the asset is called the Asset Retirement Cost, while the liability is the Asset Retirement Obligation. The ARC is depreciated over the remaining life of the asset, while the ARO is accreted over the same life; that is, an interest-type calculation is made on the liability using the same credit-adjusted risk-free rate, and the accretion expense is added to the liability, so that at the end of the asset's life, the ARO is equal to the expected (after-inflation) cost of retirement.

If you have a lease, the ARO's life is normally the same as the lease life. For an owned asset, the ARO life is typically the useful life of the asset itself.

EZ13 now offers complete ARO accounting as an extra-cost module. Reporting available includes showing ARO information on the income statement/balance sheet detail report, ARO accretion/depreciation tables, and rollforward reports (showing beginning balance, additions, accretion/depreciation, terminations, and ending balance, by lease). ARO components with varying levels of probability are accepted. For more details, including an example of an ARO calculation, please see our ARO page.

Tuesday, February 1, 2011

EZ13 data entry tips #2

See yesterday’s blog entry for information on how to copy a lease, create escalating rents, or create the full series of rents for level principal payments.

Date entry

While you can enter a date by typing it in with slashes, exactly as shown, there are other options.

- Click on the down arrow next to a date to display a calendar (on the calendar, click on the month or year to change them, or the left or right arrow to go back or forward a month).

- Click on one portion of the date (month, day, year) and press + or – to add or subtract one to that number (note: this cycles without affecting the rest of the date, so if you highlight the day on 1/31/2011 and press +, the date changes to 1/1/2011, not 2/1/2011).

- You can enter just the last two digits of the year; EZ13 guesses the century, based on the setting for your computer. By default, the window is 1930-2029. You can change it in the Regional Options of Control Panel. (Control Panel, Regional & Language Options, click on Customize, click on the Date tab, change the end date of the window.)

- You can use letters with the same meaning as Quicken/Quickbooks assigns to them:

Y, R - beginning or end of YeaR

M, H - beginning or end of MontH

T - Today

F - Forward one day

B - Back one day

All of these (except T) are cumulative: for instance, if you press Y when at the beginning of a year, the date moves to the beginning of the prior year.

F and B are different from Quicken, which uses + and - for the same purpose.

Help

Context-sensitive help is available throughout EZ13. If the cursor is in a field when you press F1, you get a description of the field and what to enter there. If a different window is displayed, information about that window is provided. Virtually the entire manual is found in the help screens.

Monday, January 31, 2011

EZ13 data entry tips #1

One of my intentions for this blog has been to provide usage notes for EZ13, FCS's lease accounting software for capital and operating leases, but I’ve ended up generally more focused on what’s happening with the FASB & IASB as they revised the lease accounting standard, because so much has been happening in that regard. Today, though, I’m going to take a moment to offer some tips on using EZ13.

There are a number of features designed to make entry of leases faster and more convenient, but many of them aren’t necessarily obvious. (They're described in the documentation, but I harbor no illusions about how much documentation is read.) I’m going to go through a few of these today:

Copy a lease

You may have several leases that are the same or almost the same (several copiers leased at the same time, for instance). EZ13 allows you to copy all the data entered for a lease to create a new lease record. Use menu item Lease/Copy; all the information from the current lease is copied to the new record, except only for the lease number (since that must be unique).

Rent Escalation clauses

Many real estate leases call for an automatic increase of rent every year or every 5 years. The increase might be a percentage or a dollar amount. (Note that if the increase is based on future events, such as the change in the Consumer Price Index, that’s considered contingent rent, and only the base rent is considered minimum lease payments for FAS 13 reporting purposes; the contingent rent is simply expensed when incurred.) Rather than needing to calculate and enter each rent amount, EZ13 allows you to specify the base rent, the increment (in dollars or percent), and when the change happens. You can separately specify the executory cost, which might remain the same or change with a different increment. Use menu item Lease/Rent Escalation. Note that the rent escalation period does not have to cover the entire life of the lease.

Level Principal Rent

Relatedly, some leases are set up so that the same amount of principal is repaid with each lease payment. Since the interest is constantly decreasing as the principal decreases, this means that each rent payment is different. Entering that for a 36- or 60-month lease can be pretty tedious! EZ13 can set up the full set of payments using menu item Lease/Level Principal Rent, you just enter the initial principal, interest rate, and length of the lease (with an option for additional fixed rent, such as a service charge that's added to each payment, and executory costs).

I’ll describe some additional input convenience features tomorrow.

Thursday, August 26, 2010

It's going to be BIG

It should also be noted that previously reported estimates of the impact of the new standard (such as Georgia Tech's study last year) are likely substantially understated, because they were based on the reported future rent commitments of companies. But those reported commitments exclude most renewal options, which now will have to be included in whole or in part. Many retail store leases have an initial term of 20 years, but then renewal options for as many as 40 more years. Under the new "expected payments" requirement, future rents reported may be double or more what is currently reported, with a commensurate increase in assets & liabilities.

Our EZ13 Lease Accounting software permits you to enter your operating leases for current reporting, but capitalize their remaining rents at a cutover date you specify for pro-forma reports in keeping with the exposure draft of the new lease accounting standard.

Friday, June 18, 2010

EZ13 v3.0 released!

* Notice dates: EZ13 can remind you that rents are changing, leases are expiring, or events that you've entered are coming up. You specify how many days before and after the event you want to be notified. When you've dealt with the matter, you can turn off display of that item without deleting the event.

* Multiple contingent rent types: You can now track up to 7 different types of contingent rent, each with their own account numbers for G/L entry. Two types are user-defined, so you can give them the meaning most relevant to your business.

* Purge leases: You may remove from a database leases that have terminated as of a date you specify. Optionally, these leases can be copied to another database.

* Purge leases: You may remove from a database leases that have terminated as of a date you specify. Optionally, these leases can be copied to another database.* Copy leases to new database: You may copy any number of leases to a new database. This can be useful for testing changes to a lease without affecting your production database.

There are a number of other, less significant features, enhancing flexibility and usability. And of course, bug fixes.

More details about the full range of features EZ13 offers are available at http://www.ez13.com/ez13.htm.

You can download a trial of EZ13 v3.0, either lessee or lessor version, at http://www.ez13.com/download.htm. If you have any questions about how EZ13 can solve your lease accounting needs, please contact me by email or (203) 652-1375.

Monday, February 1, 2010

Not your father's lease accounting

Under FAS 13, the fundamental concept is that a lease that "transfers substantially all of the benefits and risks of ownership should be accounted for as a" capital lease, representing a sale and purchase transaction, while all other leases are treated as "operating leases, that is, the rental of property." (FASB Current Text section L10 summary) Under the new standard, a right of use is recognized as a lessee asset with a matching rent liability, and a corresponding receivable and performance obligation are recognized as lessor asset and liability; these assets and liabilities are recognized for every lease (subject only to standard materiality limitations, and for lessors, to a scope exclusion for leases of less than 12 months). Off-balance-sheet financing via leasing ceases to exist.

The second conceptual change has not been highlighted as much, but is every bit as significant. FAS 13 is concerned with minimum known lease obligations. A lessee calculates the future rent commitments and the present value of future rents, and from that the asset and obligation on capital leases, based solely on the minimum amount of rent he can be required to pay. Contingent rentals are generally excluded from these numbers (unless based on an index or rate, such as CPI or LIBOR, in which case the future rents are estimated based on the initial rate, and that estimate is never changed), with actual contingent rentals paid simply expensed as incurred. If there are renewal options, they are ignored until exercised unless it is clear at lease inception that the lessee will be economically compelled to exercise them (due to bargain rents, etc.). On the other hand, a guaranteed residual is recognized at the maximum that the lessee can be required to pay, regardless of the likelihood.

The new regime can be described as "the most likely cost of the lease." Contingent rentals of all sorts are to be estimated and included, with the estimate updated each reporting period (i.e., each quarter) if there is a material change. Options are to be included if they are deemed more likely than not to be exercised, based on expectations and past practices as well as economic compulsion. (Once they are actually exercised or not exercised, the lease will of course be updated if the result is different from what was expected.)

What's the result? Many existing capital leases will need to be recalculated under the new regime. Numerous leases will need mid-term adjustments which affect both the balance sheet and the income statement. Some leasing agreements that made a lot of sense under FAS 13 may be inadvisable, and lessees and lessors may face difficult negotiations to revise the agreements to reduce their impact on the parties without disadvantaging either. Prior estimates of the impact of revising FAS 13, based on the minimum lease term and payments, will prove substantially understated for at least some leases (likely to be most affected are real estate leases with multiple lengthy options and percentage of sale contingencies, such as many store leases). As previously noted, some companies face potentially major changes to their income statement and balance sheet due to the new rules. Almost all lessees will face a deterioration of their financial ratios; if an equal amount of asset and liability is added to one's balance sheet, debt and current ratios (for all but the most unhealthy companies) will decline.

What's the benefit? The boards clearly feel that the new methodology more accurately reflects the economic reality of leasing transactions. While they are not deaf to concerns about implementation costs, in most cases they believe those concerns must bow to providing better reporting on the huge volume of leasing (an estimated $1.25 trillion in future lease commitments in the U.S. alone, which doesn't include many of the options that will be included in the new regime). In their view, an airline without airplanes on their balance sheet doesn't reflect economic reality, and neither does a store chain with no stores, that claims all of its lease commitments end in 5 years and shows tiny future rents because percentage sales fees are excluded. In addition, having a common standard for US GAAP and IFRS will be a major step forward for the boards' convergence project to have consistent accounting worldwide.

It goes almost without saying that every company's method of accounting for leases will have to be updated (software, Excel spreadsheets, whatever). Our EZ13 is no exception, and we are currently laying the plans to make the needed changes. While we already permit treating operating leases as capital on a pro-forma basis, that is only a small part of the reporting changes that will be coming. We are committed to releasing an updated version of EZ13 as quickly as possible once the new rules are finalized.

Thursday, July 23, 2009

EZ13 v2.3 released

Contingent rent: EZ13 has a new tab for contingent rent, which is rent paid that is not part of the FAS 13 minimum lease payments. Contingent rent is expensed as incurred. You can enter contingent rent in the screen tab, or upload it using an Excel® spreadsheet (requires Excel installed on your computer). (Not in Mini Edition.)

Rent escalation: EZ13 can automatically create a series of rent steps based on a periodic escalation calculation (increasing by 10% every 5 years, or 5% compounded per year, etc.). This complements the existing automatic calculation of rent for leases with level principal amortization.

Expirations report: Get a list of leases scheduled to expire between two dates.

Transfer additions and terminations: A transfer addition picks up the asset and obligation midstream for the lease; a transfer termination is almost the same as an early termination, but is designed to match a transfer addition. These are useful if a lease is being moved from one department to another, and you want to recognize the expenses up to a certain date as belonging to one account and afterwards to another (using EZ13’s account numbers feature or other distinguishing codes).

Month to month extensions: Sometimes leases are renewed after expiration on a month to month basis. There is no future rent commitment; rent is expensed as incurred (using the contingent rent feature noted above). You can optionally leave the gross asset and accumulated depreciation on the books (assuming the lease is depreciated over the lease term, the gross asset and accumulated depreciation are equal, so the net asset is zero).

Capitalize leases at incremental borrowing rate (not in Lite or Mini Editions): EZ13 has had the capability to treat operating leases as capital, using their incremental borrowing rate as the capital rate. This is intended both for current indenture reporting that some lenders require, and in anticipation of the upcoming rewrite of the lease accounting standard, which plans to capitalize all operating leases at the incremental rate. The current draft of the upcoming standard calls for all leases, including those currently capital, to use the incremental rate; there would be no limitation of the asset value to the fair market value of the underlying asset, which currently causes some capital leases to have higher interest rates. This new option lets you see the effect on your capital leases of the FASB/IASB proposal. (See prior blog entries for more information on the FASB/IASB proposed rewrite of lease accounting standards.)

Some of the feature additions were in response to requests from users of EZ13. We will continue to provide updates (at least one per year) with enhanced features at no additional cost to clients who maintain a support contract. Updated CDs are being sent to all such clients. Any clients who have not maintained their support contract can get the update by reinstating support; contact us for details.

The free demo available for download on our website has been updated to v2.3, so you can try out the new features yourself.

Tuesday, May 5, 2009

Types of EZ13 reports

EZ13 provides several types of reports. Let's look at what each provides. (I'll describe specifically the spreadsheet output type #1; the text report includes basically the same information, but laid out differently.)

1) Income Statement/Balance Sheet Detail: This is our most comprehensive report of calculated information (all of the accounts involved in lease accounting for a period). We've tried to break out every account so you can see exactly what's happening. Each balance sheet account, for instance, shows five different values: beginning balance, added (for new leases), activity, removed (for terminations), and ending balance. In all, this report shows some 74 columns of calculated data, plus as many as 43 columns of descriptive information (including account numbers if you define them).

And that's just the first tab. On the second tab, we show the future minimum rent information. If you get minimum rents broken out by year for the first 5 years, then all remaining as a lump sum (as FAS 13 requires), the second tab shows 42 columns of calculated data per lease.

2) Income Statement/Balance Sheet Compact: Maybe that's overkill for you. The compact report shows 16 columns of calculated data, giving the essential highlights (just the ending balance for each balance sheet account, for instance).

3) Journal Entries: You may prefer to see each transaction a lease generates in journal entry form (each rent payment is a debit to obligation, a debit to accrued interest, and a credit to cash; etc.). Each line shows the lease number, period start and end date, account name, account number (if defined), debit or credit, and a description of the transaction so you know which lines go together and what they're for.

4) Amortization Schedule - Capital & Operating: You can view the activity for the entire life of a lease, with a separate line entry for each rent payment. Note that this report can get very large if you have many long leases; if you have several hundred leases that run 20 years or more paid monthly, you could exceed the maximum number of rows (65536) in versions of Excel before Office 2007. If that happens, you'll need to select subgroups of leases to report on (or upgrade Excel; the 2007 version permits over 1 million rows).

5) Future Minimum Rents: This report is identical to the second tab of the Income Statement/Balance Sheet Detail report. It's provided in case you only need future rent information.

6) Depreciation Over Economic Life: If you have leases that have an ownership transfer or bargain purchase option, they are depreciated over their economic life, which in most cases is longer than the lease term. Regular EZ13 reports stop reporting on a lease when it expires. This report shows the depreciation after the lease's expiration, until the end of its economic life.

7) Classification Summary: Lists how each lease fits into the four tests for capitalization; if the lease is capital, its capital rate is shown.

8) Listing: As mentioned above, this report is not available in spreadsheet format except as an export of a text report. The reason is that there is really no way to show all the input information for a lease across a single row: There can be an indeterminate number of rent steps, for instance, which can easily overwhelm the maximum number of columns in Excel.

I hope this helps you get the results most useful to you. Most accountants and financial people live in Excel, and it's also a common method of importing and exporting data (such as loading results of EZ13 into a general ledger system). Knowing the best way to get the spreadsheet information you want can make EZ13 much more useful.

Monday, May 4, 2009

EZ13 spreadsheet output

Based on questions we've gotten from customers, it seems there's some confusion about the ways to get output, particularly spreadsheet output. EZ13 offers two different ways to get spreadsheet output, each having a different purpose.

1) Most people wanting spreadsheet output will want a format where each lease is on a single line, with the accounts and values for that lease each in a separate column. For this type of output, you should choose output to "Spreadsheet" in the report setup page:

As soon as you click on the Spreadsheet button, EZ13 will open a dialog box for the name of the spreadsheet. Most people will create an Excel spreadsheet (.xls format). However, this requires that you have a valid installation of Excel on your computer. If you do not, you can create spreadsheet output in XML format, which can be read by Excel, OpenOffice Calc, and various other spreadsheet applications. To select XML output, go to the File menu, choose System Options, and check the box labeled "XML spreadsheet output." (XML output is also a bit faster to create, and less subject to memory limitations with very large reports.)

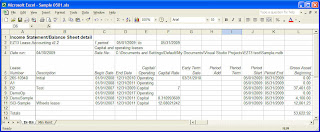

Once you click on Generate Report, EZ13 will build the spreadsheet. The output for an Income Statement/Balance Sheet Detail report looks something like this:

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).

Each row shows a different lease. There is a column for the lease number, description, begin date, end date, gross asset beginning value, and so on. The last row is a totals line, which is the summation of all the columns that have value information (as opposed to descriptive information).2) The other way to get spreadsheet output is using the Export feature of the text output. Text output is designed to be easily readable, putting all the information for a lease together on several lines so that you don't have to constantly scroll back and forth across the line. However, that makes it much less practical to manipulate (sort, select, sum, etc.) in Excel. One advantage of this method of getting spreadsheet output, however, is that the report writer can create an Excel spreadsheet without you having Excel installed on your computer. Also, this is the only way to get a spreadsheet of the listing report, which lists all the input data for a lease.

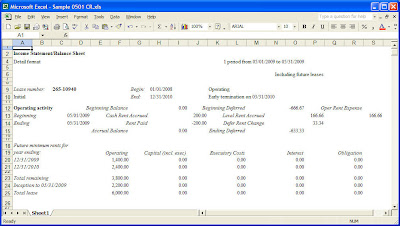

If you create a text output version of this same report, then export it to Excel, it will look something like this:

This is basically a repeat of what you see on the screen for a text report. Note that sometimes the columns won't line up correctly; the report writer is trying its best to guess what should be aligned, but it doesn't always make the right decisions, and unfortunately there's no way for us to tweak the results. In most cases, an export to PDF, HTML, or a Word .doc document is going to give better looking results. But if you really prefer to get information in Excel format, it's here.

Thursday, April 30, 2009

DP Review: Overall comments

Change is coming. There is no question that both boards are adamant that leases need to be on the balance sheet. Operating leases will cease to exist for lessees once this standard takes effect, with only a possible exception for very short-term leases. The impact of this is expected to be substantial for many industries, particularly retail chains (including restaurants), airlines, property management firms, and others with large amounts of assets held under operating leases. We can also expect a substantial impact on lessors; one reason for leasing is off-balance-sheet financing, and with everything being on the balance sheet, one can expect that some leases will be less financial advantageous to the lessee, and so won’t get done, or at least not with the same terms.

When FAS 13 was first issued in 1976, it was the most complex standard the FASB had released (and probably more complex than standards released by its predecessors as well). The new standard is no doubt intended to be less complex, in keeping with the move to principles-based rather than rules-based accounting. But the wide variety of leasing transactions means some inherent complexity as the boards seek to develop a consistent methodology.

Another big change in the accounting is the requirement for continuous review and adjustment. FAS 13 was basically “set and forget”: the terms in effect at the inception of the lease controlled accounting for the entire lease term, unless there was an actual renegotiation. A renewal or termination option was not recognized until officially exercised. Contingent rents were expensed as incurred, with no implications on future rents (either the minimum rent disclosures or the asset & obligation of a capital lease).

With the new standard, the lessee would review all of these every reporting date (in the U.S., that generally means every quarter). Contingent rent is estimated from the very beginning of the lease, and as it changes, the rent obligation would be recalculated (though the boards can’t agree whether the balancing entry would be to asset or profit). Options to renew will be included based on factors outside the lease such as the loss of valuable leasehold improvements, relocation costs, and industry practice, not just the existence of a penalty or other factors in the lease itself, and this inclusion decision would again be reviewed quarterly, not just when the option exercise date arrives. (For U.S. lessees, the SEC Chief Accountant’s letter of Feb. 7, 2005, made leasehold improvements a reason to include renewal options, but this proposal’s wording is broader.)

This means that the calculations for capital leases are going to become more complex, particularly in handling midcourse adjustments, which are likely to become much more numerous. (Any retail store lease with a percentage of sales kicker will probably need to be adjusted every quarter to reflect actual sales; leases with CPI clauses will need adjustments at least once a year, and perhaps quarterly.) Since some changes in rents can result in a change to both the obligation and the asset, there is no certainty that the periodic depreciation charge will remain the same throughout the lease (since the asset being depreciated may change). Depending on how the boards resolve their disagreements, it’s possible that gains and losses will be recognized in the middle of the life of a lease when certain changes are recognized, rather than just at termination.

For all the work done, there is much left to accomplish. And one topic hasn’t even been discussed: transition to the new standard. How are existing leases to be recognized? Restate from inception? Grandfather? Set up as if a new lease on a specific day, or the first day of the fiscal year in which the standard takes effect? For capital leases which change, does the change hit profit or retained earnings, or is it part of the new lease’s carrying amount?

The boards welcome public input; that’s the purpose of a discussion paper. If you want to make a response, you are invited to contact either board (but not both; all comments will be shared between the two boards), by July 17, 2009.

FASB email: Send to director@fasb.org, File Reference #1680-100.

IASB online: Use their web form for comments.

Note that all comments will become part of the public record, available on the boards’ web sites.

FCS is committed to updating EZ13 to meet the new lease accounting standard once it is released. The current Standard Edition of EZ13 includes the ability to treat operating leases as capital at their incremental borrowing rate; we are adding the ability to use the incremental borrowing rate on capital leases in v2.3, which we expect to release next month.

Thursday, April 16, 2009

Initial measurement of leases

Summary:

A lease is to be valued at the present value of the rents due, using the lessee's incremental borrowing rate as the interest rate. The asset and obligation start with the same value. There is no limitation to the asset's fair market value (unlike the current standards).

Detailed review:

Conceptually, the boards wish to determine the initial asset and obligation of the lease by determining its fair value. The boards decided that the fair value of the obligation to pay rentals is not always obvious, and therefore decided to use a discounted cash flow methodology for measurement. This is the same type of methodology used currently for capital leases, and similar to some other financial instruments.

Calculating a discounted cash flow requires deciding on an interest rate to use. The boards considered two possible rates to use:

- The interest rate implicit in the lease (the discount rate needed to make the present value of the rents plus the unguaranteed residual equal to the fair value of the leased asset plus the lessor’s initial direct costs)

- The lessee’s incremental borrowing rate (the interest rate the lessee would pay on a similar lease or to borrow a similar amount of money over a similar term to purchase the asset)

The boards rejected the implicit rate because it is often difficult for lessees to determine (they may not know the residual value or the initial direct costs); it was particularly noted that for many leases currently considered operating, the unguaranteed residual can be a large percentage of the total value, and thus mistakes in valuation could significantly affect the calculation.

The boards decided to use the present value of the rents, at the incremental borrowing rate, as the value of both the asset and the obligation at the inception of the lease. They rejected a separate calculation of the fair value of the right-to-use asset, considering “measurement at cost” for the asset to be consistent with the initial measurement of other non-financial assets and less costly to determine than a fair value measurement.

This means that the current capital lease requirement of limiting the gross asset value to not more than the fair market value of the asset will be eliminated.

Those who disagree with the boards’ conclusions are asked to offer their recommended alternative and reason for the switch.

EZ13 has an option to report operating leases capitalized using their incremental borrowing rate, as contemplated by the discussion paper, so you can see today how this change would affect your reporting.

Thursday, March 19, 2009

Contingent rent, now and future

Under FAS 13, contingent rents are handled in one of two ways. Both are based on the overall concept of making a one-time estimate at the beginning of the lease, and expensing the difference between the estimate and the actual payment when the payment is made.

1) If the amount to be paid is based on usage, such as a percentage of sales or machine hours of use, the up-front estimate is zero. All payments based on usage are considered contingent rent, and fall outside of the "minimum lease payments" for the lease (since if you end up not using the asset, your minimum charge is 0); they are expensed as incurred.

2) If the amount to be paid is based on a rate or index, such as LIBOR or the consumer price index, the minimum lease payments are calculated as if the rate or index will be the same over the entire life of the lease. This calculation is not changed over the entire life of the lease (unless the agreement is renegotiated). The difference between the estimate and the actual payment is expensed as incurred; note that this difference could be positive or negative.

One question that often comes up is whether to treat the CPI as a rate or as an index. Officially, CPI is an index, showing the value of a basket of goods and services. The overall value was normed to 100 in 1967; the percentage increase that is broadcast on the news is the change in that index. While some companies take the position that they should assume the current rate of increase in calculating their minimum lease payments, a strict reading of FAS 13 seems to indicate that instead one should assume that the index will not change, i.e., there will be no inflation (or deflation), and future inflation adjustments will be treated entirely as contingent rent.

Of course, if the increases in rent are specified in advance, they must be considered part of the minimum lease payments, even if they're supposedly intended to cover inflation. The key is whether the rent amount is known at inception, or dependent on future events.

The current version of EZ13, v2.2, does not track contingent rents at all, because they're not part of the minimum lease payments. However, we are currently working on a new release which will include the ability to record and report contingent rents; that will be released later this year.

The FASB/IASB revision plans to change this. According to the boards' current thinking, lessees will need to estimate their rents for all types of contingent rent. Unfortunately, the two boards have differing opinions on how to estimate: The FASB wants to use a "best estimate" approach, while the IASB wants a probability-weighted expected outcome approach. Both want lessees to remeasure their leases at each reporting date (normally every fiscal quarter), with the obligation changed by the change in present value of the remaining rents. They disagree about how to balance the change transaction: for changes caused by contingent rents, the FASB wants an immediate recognition of profit or loss, with no change to the carrying value of the asset, while the IASB wants to add or subtract the change to both the obligation and the asset. The depreciation on the asset would then be altered to depreciate the remaining asset over the remaining life.

Since the boards intend to release a united standard, some negotiation between the boards will be necessary to resolve this. Further, it remains to be seen how companies and users of financial statements will respond to this idea; clearly this is a potentially large increase in the complexity of accounting for leases, with the possibility that valuations would change every quarter with corresponding changes in interest and depreciation, along with the change in the actual rent.